Digital 2022 April Global Statshot Report

Team Locowise posted on 21 April 2022

Locowise is a proud data partner of the Global Digital Reports, published by Datareportal in partnership with We Are Social and Hootsuite.

The Digital 2022 April Global Statshot Report is now live. The latest quarterly update highlights the significant growth in the number of internet users, which now stands at 5 billion people worldwide – 63% of the world’s total population. The 300 page report shares a wealth of data for readers to benefit from and use to guide their digital strategy.

Key points to note from the April Statshot Report include:

Internet Usage

▪️ The world’s internet users now spend an average of 6 hours and 53 minutes online each day. This is down slightly from the 6 hours and 57 minutes recorded at the start of the year.

▪️ Southern Asia is home to the largest offline population, with more than a third of the world’s “unconnected” living in the region. 744 million people remain offline in India, equating to more than half (53%) of the country’s population, and more than a quarter of the world’s unconnected.

▪️ China still has a large unconnected population too, despite the country’s internet users now numbering well over 1 billion. Data from CNNIC indicates that roughly 415 million people remain offline in China, equating to 28.7% of the country’s total population.

▪️ New research from GWI confirms that “finding information” is still the top motivation for using the internet. More than 6 in 10 internet users (60.2%) between the ages of 16 and 64 cited this as one of the primary reasons why they went online in Q4 2021.

Social Media Usage

▪️ Social media user growth rates have slowed over the past three months compared with the quarterly growth rates we’ve been seeing since the start of the COVID-19 pandemic. Kepios analysis reveals that global social media users have only increased by 32 million since the start of 2022, equating to quarterly growth of 0.7%.

▪️ The global total has still increased by 7.5% year on year though, with an additional 326 million new users over the past 12 months taking the global count to 4.65 billion by the start of April 2022. This figure may not represent unique individuals, but it does indicate that well over 9 in 10 internet users now visit social media platforms every month.

▪️ Skai.io reports that the cost of 1,000 social media ad impressions (CPM) increased by 15% between Q1 2021 and Q1 2022. Social media click-through rates (CTR) also fell sharply in the first three months of this year compared with the previous three-quarters, although Skai’s analysts caution that this may be partly due to an increased preference for video advertising.

▪️ After a dip in global reach at the end of last year, Pinterest’s planning tools suggest that the platform’s ad audience has already recovered its losses. Global Pinterest ad reach stood at 235 million in April 2022, pointing to quarter-on-quarter growth of 4.1%.

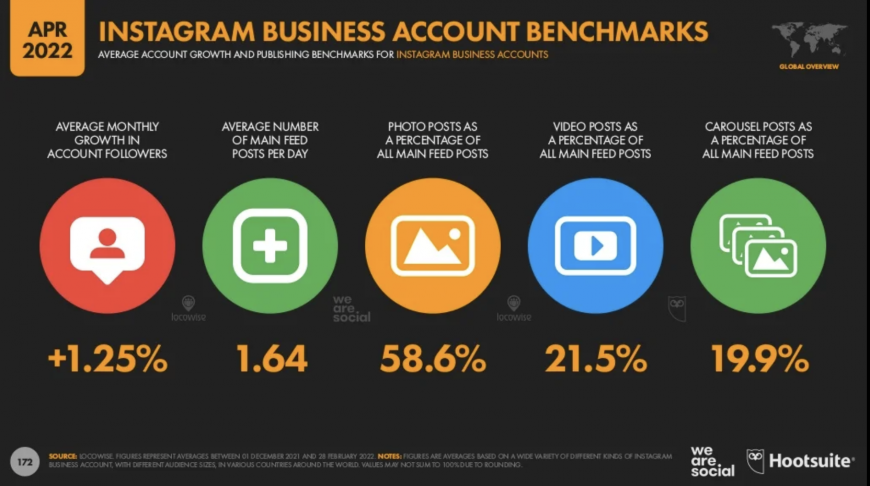

▪️ The average engagement rate for Instagram Business Accounts is highest for carousel posts at 0.85%. The lowest rate is for video posts at 0.47%

▪️ The average engagement rate for Instagram Business Accounts is highest for accounts with fewer than 10,000 followers at 1.27%. The lowest rate is for accounts with more than 100,000 accounts at 0.58%

▪️ For Instagram Business Accounts, the average monthly growth in followers is +1.25%

▪️ Facebook post engagement is highest for accounts with fewer than 10,000 followers at 0.27%. The lowest rate is for accounts with more than 100,000 followers at 0.04%

▪️ The latest numbers published in Bytedance’s advertising resources reveal that TikTok’s advertising reach grew faster in the first three months of 2022 than it did in the final three months of 2021.

▪️ Marketers can now reach 970 million users aged 18 and above with ads on TikTok, which is almost 10 percent higher than the number of users that they could reach at the start of this year. For context, that means TikTok’s adult audience is currently growing at a rate of almost 1 million new users every day.

▪️ The United States accounted for the greatest share of TikTok’s consumer revenue in Q1, with Americans spending more than USD $310 million on in-app purchases between January and March 2022.